As a new government contractor, you might be preparing for your first DCAA compliance audit. If so, you’re likely getting your various business units to run through programs, recheck financial/accounting software, and make sure everything is prepared for when the auditor comes. You might even have some questions about how to prepare your systems, and GovCon365 is here to help.

GovCon365 has more than 20 years of experience helping government contractors maintain their ERP systems and setting them up for compliance. Our employees who know compliance inside and out, and have helped numerous clients navigate their way through audits successfully. Given our knowledge of regulations, the audit process, and compliant systems, we have a few tips for the newcomers to government contracting. Here are seven tips that we’ve given clients over the years to help their organization prepare for a first DCAA audit.

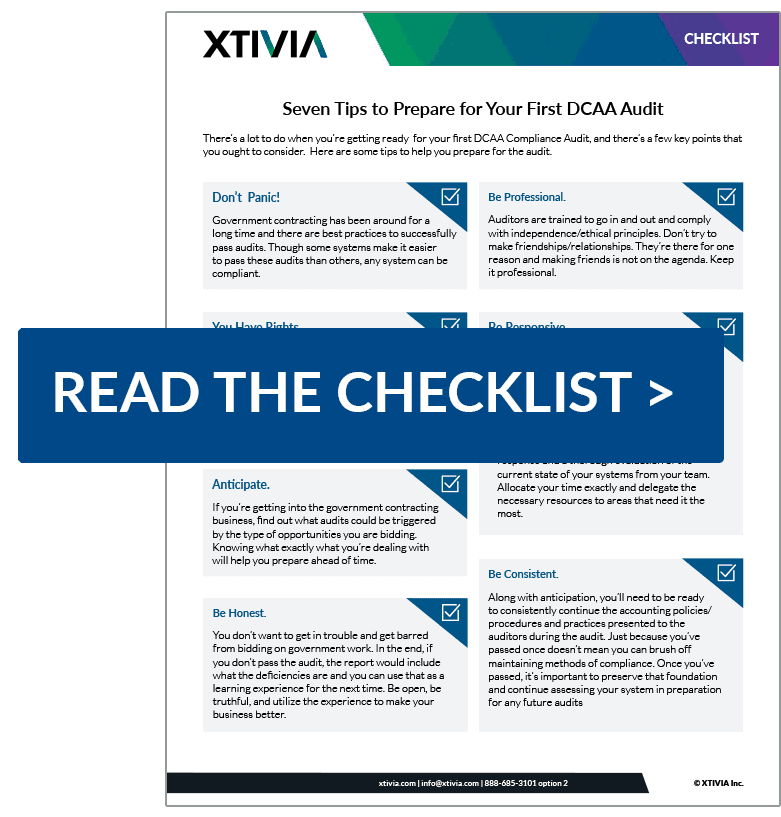

1. Don’t panic.

- Government contracting has been around for a long time, and there are best practices to pass audits successfully. Though some systems make it easier to pass these audits than others, any system can be compliant.

2. You have rights.

- Although on the streets you have the right to remain silent and hire a lawyer, in government contracting it might not be practical to afford this option. But you have the right to answer and provide only the information requested. There is no need to give more or provide information not requested.

3. Be Honest.

- You don’t want to get in trouble and get barred from bidding on government work. In the end, if you don’t pass the audit, the report would include what the deficiencies are, and you can use that as a learning experience for the next time. Be open, be truthful, and utilize their expertise to make your business better.

4. Anticipate.

- If you’re getting into the government contracting business, find out what types of opportunities and bids trigger specific audits. Knowing what you’re dealing with will help you prepare ahead of time.

5. Consistent.

- Along with anticipation, you’ll need to be ready to consistently continue the accounting policies/procedures and practices presented to the auditors during the audit. Just because you’ve passed once doesn’t mean you can brush off maintaining methods of compliance.

6. Responsive.

- Don’t over promise and under deliver. Government auditors are going to be aggressive, but if you need more time, be ready to justify it with background information. “It takes too long to gather/prepare the data” would not be a good excuse these days due to technology/adequate accounting systems.

7. Be Professional.

- Auditors are trained to go in and out and comply with independence/ethical principles. Don’t try to make friendships/relationships. They’re there for one reason and making friends is not on the agenda.

Passing compliance audits isn’t just about knowing that your business won’t incur penalties or fines. These inspections keep companies operating responsibly. Maintaining proper financial and accounting documentation and organization is a way to show auditors and your clients that your business works ethically and responsibly. When you abide by the regulations and run your business with compliance in mind, you’re more likely to win more contracts and grow as an organization.

We hope these tips help you and wish you good luck on your audit. If you’re feeling overwhelmed by compliance issues, we can help you get to where you want to be. Please feel free to engage with us in the comment section or reach out to GovCon365 for all your ERP and compliance needs.